A Power of Attorney (PoA) in the UK is a legal document that grants someone the authority to act on your behalf in legal, financial, or personal matters. This arrangement is commonly used when a person is unable to manage their affairs due to illness, disability, or absence. The person given the authority is called the “Attorney,” and the person granting the authority is known as the “Donor.” In this guide, we will explore the types of Power of Attorney in the UK, the process of creating one, and key considerations.

1. Types of Power of Attorney in the UK

There are several types of Power of Attorney in the UK, each serving different purposes. The most common types are:

- Lasting Power of Attorney (LPA):

- An LPA is the most widely used type of PoA in the UK. It is a legal document that gives someone the power to make decisions for you when you are no longer able to do so due to mental incapacity. There are two types of LPAs:

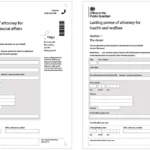

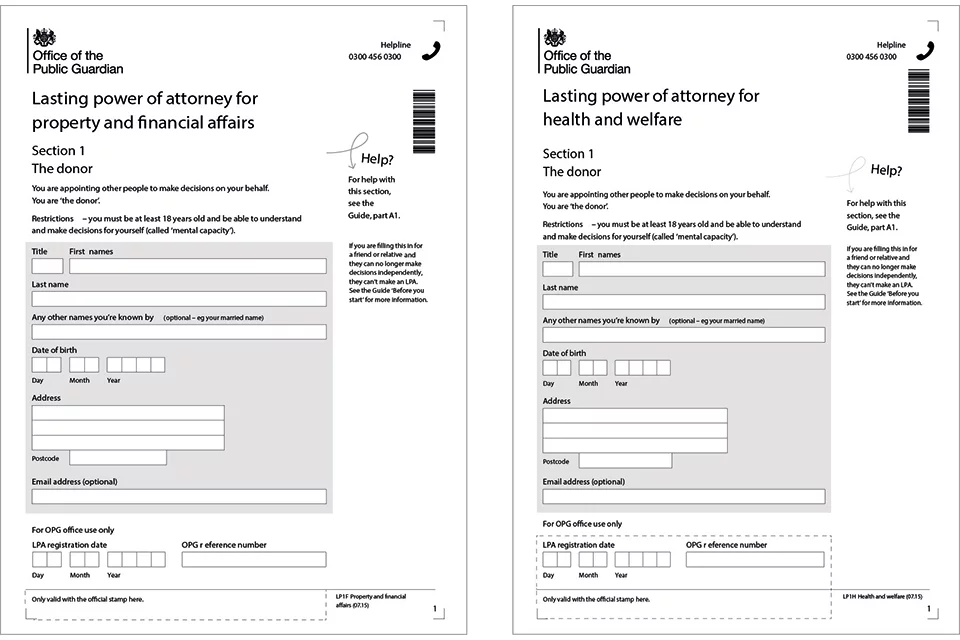

- Health and Welfare LPA: This gives the Attorney the authority to make decisions about your healthcare, medical treatments, and living arrangements. This can only be used when you lack the mental capacity to make such decisions yourself.

- Property and Financial Affairs LPA: This gives the Attorney authority over your finances, such as managing your bank accounts, paying bills, and handling property-related matters.

- An LPA is the most widely used type of PoA in the UK. It is a legal document that gives someone the power to make decisions for you when you are no longer able to do so due to mental incapacity. There are two types of LPAs:

- Enduring Power of Attorney (EPA):

- EPAs were used before October 1, 2007, and are no longer available for new applications. However, those that were made before that date are still valid. EPAs only cover decisions related to property and financial affairs, and they continue to be valid if the donor becomes mentally incapacitated.

- General Power of Attorney:

- A General Power of Attorney grants someone authority to make specific decisions on your behalf, typically related to business transactions or financial matters. Unlike LPAs, a General PoA automatically ends if the person granting it loses mental capacity.

- Specific Power of Attorney:

- This is a limited PoA that gives an Attorney authority over a single matter or a set of actions. It could be used for things like selling a property, managing a business, or handling other specific legal tasks.

2. Who Can Be Your Attorney?

In the UK, the person you appoint as your Attorney should be someone you trust, as they will have significant control over your financial and personal decisions. The appointed person must be at least 18 years old and mentally capable of managing the responsibilities you assign to them.

You may appoint:

- A family member or a friend.

- A professional (such as a solicitor or accountant), though they may charge for their services.

It’s important to ensure that your Attorney understands the responsibilities that come with the role and is willing to act in your best interests.

3. How to Set Up a Power of Attorney

Setting up a Power of Attorney in the UK is a straightforward process, but it requires careful consideration. The process typically involves the following steps:

- Choose Your Attorney:

- Decide who will act as your Attorney. You can appoint more than one person if you prefer, and they can act either jointly (together) or jointly and severally (separately).

- Complete the Forms:

- For Lasting Power of Attorney (LPA), you must complete the official form from the Office of the Public Guardian (OPG). The forms for both Health and Welfare and Property and Financial Affairs can be downloaded from the OPG website or filled out online.

- For Enduring Power of Attorney (EPA), you will need to use the form available from the OPG.

- Sign the Document:

- The donor must sign the PoA document, and it must be witnessed by a third party (usually a solicitor or another person who is not involved in the PoA). The Attorney must also sign to confirm they accept the role.

- Register the Power of Attorney:

- For an LPA, the document must be registered with the Office of the Public Guardian before it can be used. This process can take several weeks.

- EPAs that were created before October 2007 don’t need to be registered unless the donor becomes mentally incapacitated, at which point registration is required.

- Inform the Attorney and Others:

- Make sure that your Attorney knows about their appointment and understands the powers they will have. You should also inform relevant people, such as your bank, of the appointment.

4. What Powers Can Be Given in a Power of Attorney?

The powers granted in a Power of Attorney vary depending on the type of PoA and the specific wishes of the donor. Common powers that can be given to an Attorney include:

- Managing finances: This includes handling bank accounts, paying bills, managing investments, and dealing with taxes.

- Making healthcare decisions: The Attorney can make decisions regarding medical treatments, care, and housing arrangements if you are unable to make those decisions yourself.

- Managing property: An Attorney can manage the sale or purchase of property, lease agreements, or repairs.

- Accessing personal information: An Attorney can manage access to your personal records, including medical and financial documents.

The powers granted should always be outlined clearly in the Power of Attorney document to avoid any confusion.

5. Safeguards and Monitoring of Power of Attorney

While a Power of Attorney can grant significant control over one’s affairs, there are safeguards in place to protect against abuse. Some key safeguards include:

- Registration with the OPG: For LPAs, the document must be registered with the Office of the Public Guardian before it is valid. This offers a level of security, as the OPG will keep a record of the document.

- Certificate Provider: A certificate provider, typically a solicitor or doctor, must confirm that the donor understands the Power of Attorney and is not under any pressure or duress to create it.

- Regular Monitoring: The OPG can investigate complaints or concerns about the actions of an Attorney, and they have the power to remove an Attorney if they are found to be acting improperly.

6. Ending a Power of Attorney

In certain situations, a Power of Attorney can be revoked. The donor can cancel the PoA at any time, as long as they have mental capacity. To revoke a PoA, the donor must inform their Attorney in writing and notify any relevant institutions (such as banks or health care providers) that the Power of Attorney is no longer valid.

If an Attorney believes the donor is no longer mentally capable or is acting outside the terms of the agreement, the Attorney may also step down from their role. In the case of an LPA, the Office of the Public Guardian must be notified of any changes.

7. Legal Requirements and Costs

Creating a Power of Attorney in the UK is generally affordable. However, there are some associated costs, particularly if you seek professional advice. The costs of registering an LPA with the Office of the Public Guardian are typically around £82, although this can vary based on your circumstances. If you appoint a solicitor to help with the process, their fees will depend on the complexity of the document and their hourly rate.