Securing a home loan is a significant financial decision, and one of the most important factors for borrowers to consider is the interest rate. The interest rate determines how much you will pay over the life of the loan, affecting your monthly repayments and the total amount you pay for your home. In Australia, home loan interest rates can vary widely depending on the lender, the type of loan, and your financial situation. Finding the lowest interest rate home loan can save you thousands of dollars over the life of your mortgage.

This guide explores how to find the lowest interest rate home loans in Australia, the factors that influence interest rates, and the types of loans available for borrowers.

Factors That Affect Home Loan Interest Rates

Before diving into the specifics of the lowest interest rates, it’s important to understand the factors that influence the rate you’ll be offered by lenders.

1. Loan Type

The type of home loan you choose will affect the interest rate. Fixed-rate loans, which lock in an interest rate for a set period, tend to have slightly higher interest rates than variable-rate loans, which can fluctuate based on market conditions. Some loans also combine both, offering a split rate, which could give you the advantage of lower interest rates for part of your loan.

2. Loan Term

The term of the loan (usually 25 or 30 years) can impact the interest rate. Typically, loans with shorter terms have lower interest rates because they represent less risk for lenders, whereas longer-term loans can attract higher rates.

3. Loan-to-Value Ratio (LVR)

The Loan-to-Value Ratio (LVR) is the percentage of the property value that you are borrowing. A lower LVR typically results in a lower interest rate. If you have a deposit of at least 20% of the property’s value, you will avoid Lenders Mortgage Insurance (LMI), which could further lower your overall cost of the loan.

4. Credit History

Your credit score plays a key role in the interest rate you are offered. A higher credit score typically results in a lower interest rate because lenders see you as a lower-risk borrower. If you have a poor credit history, you may be offered a higher interest rate to offset the risk.

5. Economic Conditions and RBA Decisions

The Reserve Bank of Australia (RBA) cash rate is a key driver of interest rates in the Australian home loan market. When the RBA adjusts the cash rate, lenders may pass on those changes to their borrowers. In times of economic stability or low inflation, interest rates tend to be lower.

6. Lender’s Policies

Different lenders have different policies regarding risk and competition, which can affect the interest rate they offer. Major banks, smaller banks, and non-bank lenders may offer varying rates, even for similar loan types. It’s essential to shop around and compare multiple lenders before deciding.

How to Find the Lowest Interest Rate Home Loan

Finding the lowest interest rate for your home loan in Australia requires research, comparison, and understanding your financial situation. Here are some tips for securing the best possible rate:

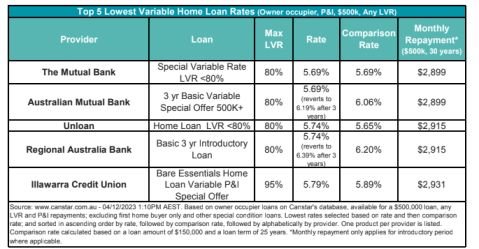

1. Compare Lenders and Loan Products

The Australian home loan market is competitive, with many lenders offering different interest rates and features. Start by comparing rates across a range of lenders, including major banks, credit unions, and online lenders. Use comparison websites that allow you to filter home loans based on interest rates, fees, and features to find the most competitive deals.

2. Consider Your Loan Type and Features

If you’re looking for a low interest rate, consider the type of loan that suits your financial situation. For example, if you can handle some fluctuation in repayments, a variable-rate loan may offer a lower rate than a fixed-rate loan. Similarly, loans with features like offset accounts or redraw facilities might have slightly higher interest rates but offer added benefits that could save you money in the long term.

3. Negotiate with Your Lender

Many lenders are willing to negotiate on interest rates, especially if you have a strong credit score or a large deposit. Don’t hesitate to ask for a better rate or enquire about any special offers. If you already have a mortgage with a lender, you may be able to negotiate a lower rate when you renew or refinance.

4. Make a Larger Deposit

The size of your deposit is one of the most significant factors in determining the interest rate you’ll receive. The larger your deposit, the lower the LVR, and the lower the interest rate you’re likely to be offered. For example, if you can save a 20% deposit, you can avoid LMI and potentially secure a lower rate.

5. Maintain a Strong Credit Score

A higher credit score is associated with lower interest rates. To ensure you qualify for the lowest interest rate, check your credit score before applying for a loan. If your score is lower than you’d like, work on improving it by paying down any outstanding debts, reducing credit card balances, and making sure your bills are paid on time.

6. Consider Refinancing

If you already have a home loan, refinancing can be an effective way to secure a lower interest rate. This process involves transferring your current mortgage to another lender with a more competitive rate. Refinancing may come with some fees, but the long-term savings on interest can be worth it.

Current Trends in the Australian Home Loan Market

As of recent years, interest rates in Australia have been relatively low, which has made borrowing more affordable for many. However, the rate you qualify for will depend on several factors, such as your deposit size, credit score, and loan amount. The Reserve Bank of Australia has kept the official cash rate low to encourage borrowing and support the economy, but rates may fluctuate based on changes in the economy.

Fixed vs. Variable Rates

In general, variable-rate loans tend to offer lower initial interest rates than fixed-rate loans. However, this rate can change over time, potentially increasing your repayments. Fixed-rate loans provide stability, allowing you to lock in an interest rate for a specific period (usually one to five years), but they often come with slightly higher rates.

Special Offers and Discounted Rates

Many lenders offer promotional or discounted interest rates to attract new borrowers. These offers typically apply for an introductory period, after which the interest rate may revert to a higher standard rate. Make sure you understand the terms of these offers and consider whether the long-term costs outweigh the initial savings.

Common Fees and Charges Associated with Home Loans

While securing the lowest interest rate is important, it’s equally essential to consider the fees and charges that come with a home loan. Some fees may be one-off costs, while others are ongoing expenses. Below are common fees to watch out for:

1. Application Fees

Some lenders charge an application fee when you apply for a home loan. This fee can range from a few hundred to over a thousand dollars, depending on the lender.

2. Establishment Fees

These are one-off fees that are charged when you first take out the loan. These fees can cover the administrative costs of setting up your loan.

3. Monthly or Ongoing Fees

Many lenders charge a monthly or annual fee for maintaining the loan. While some lenders offer fee-free loans, others may charge for account keeping and service.

4. Exit Fees

If you decide to pay off your loan early or refinance, some lenders charge exit fees. These can be significant, so it’s important to understand the terms of your loan and check for any early exit penalties.

5. Lenders Mortgage Insurance (LMI)

If you borrow more than 80% of the property’s value, you may be required to pay LMI. This is an insurance premium that protects the lender in case you default on your loan. While LMI does not protect the borrower, it is a cost you should consider when calculating the total cost of your loan.